1.1 The broad legal positions are as follows- Dealing in shares whether Investment or Business

Dealing in shares can result either in "Business income" (chargeable as Profits & Gains of Business or Profession chargeable under section 28 of the Income Tax Act, 1961) or "Capital Gains" (chargeable under Sec.45 of the Act). Thus, dealings in shares could either be in the course of business - chargeable as Business Income, OR for the purpose of investment - chargeable as Capital Gains. Classification into Business Income and Capital Gains depends on facts & circumstances of each case. However, as a very broad guideline, as held in many cases, it can be said that - ordinarily, the purchase and sale of shares with the motive of earning a profit, would result in transaction being in the nature of trade, but where the object of investment in shares of a company is to derive income by way of dividend etc., then the profit accruing by sale of shares will yield capital gains and not revenue gains (business income).

2. This article deals with the situation where trading in shares have been considered as business income

3. Explaining Speculation and Non Speculation Business:

Trading in shares can be of two types namely

A) Delivery based trading

B) Non delivery based (also called intraday trading)

3.1. DELIVERY BASED TRADING:

Under this type of trading, the share transaction is said to be complete only when there is actual delivery of shares/securities upon the settlement of transaction i.e. in other words, when shares are purchased/ sold on delivery basis, then those shares will be transferred to/from Demat account of the buyers/sellers. The buyer of the share will have to pay the full value of share and the share will become his asset with that either he can trade in his business or hold for investment.

3.2. NON DELIVERY BASED TRADING (or intraday trading):

Intraday trading by the name itself one can get a view that it refers to the trading system where the traders have to square-off their trade on the same day. Squaring off the trade means that the traders have to do the buy and sell or sell and buy transaction on the same day before the market close. In other words in this trading, shares are not actually transferred to the DEMAT account of the buyer instead they have to square off their position before the market close on same day by selling the same number of shares. The buyer of the shares will not pay the full value of shares instead he will pay only the difference margin arising on account of such buy/sell transaction.

3.3 Speculative Business Income:

3.3.1. Income from intra-day trading is considered as speculation income and taxed as such.

3.3.2. As per Section 43(5) of the Income Tax Act, 1961, intra-day trading shall be considered as speculation business transactions and the income therefrom would be either speculation gains or speculation losses. Income from speculation gains is taxed at the normal rates.

3.3.3. Intra-day trading is the trading of shares within the same day. Generally, delivery is not taken in case of intra-day trading, and thus, these are said to be speculative transactions. As per Section 43(5) of the Income Tax Act, 1961, the said transactions shall be considered as speculation business transactions and the income therefrom would be either speculation gains or speculation losses.

3.3.4. For a person earning income from any head of income, intra-day trading in shares is always treated as speculative business. Section 43(5) of the Income Tax Act, 1961, deals with speculative transaction. It states that a transaction of purchase or sale of a commodity including stocks and shares settled otherwise than by actual delivery or transfer of the commodity or scrip is a speculative transaction.

3.3.5. In intra-day trading in shares, there is no actual delivery as the shares enter and exit from the trading account on the same date and it does not enter the DEMAT account at all.

3.4 Non Speculative Business Income:

3.4.1. Income from trading F&O (both intraday and overnight) on all the exchanges is considered as non-speculative business income as it has been specifically defined this way. F&O is also considered as non-speculative as these instruments are used for hedging and also for taking/giving delivery of underlying contract. Even though currently almost all equity, currency, & commodity contracts in India are cash settled, but by definition they give rise to giving/taking delivery (there are a few commodity future contracts like gold and almost all agri-commodity contracts with delivery option to it).Income from shorter term equity delivery based trades (held for between 1 day to 1 year) are also best to be considered as non-speculative business income if frequency of such trades executed by you is high or if investing/trading in the markets is your main source of income.

3.4.2. Profit / Loss in derivatives (futures and options) is treated as non-speculation business even though delivery is not effected in such transactions.

3.4.3. From the reading of the above it is clear that trading in derivatives including commodity derivatives on a recognized stock exchange will not be considered as a speculative transaction and hence not treated as speculative business. Therefore since these are not considered as speculative business, therefore income from such transactions will be considered as normal business income and loss from such transactions will be considered as normal business loss.

4. How is turnover computed.?

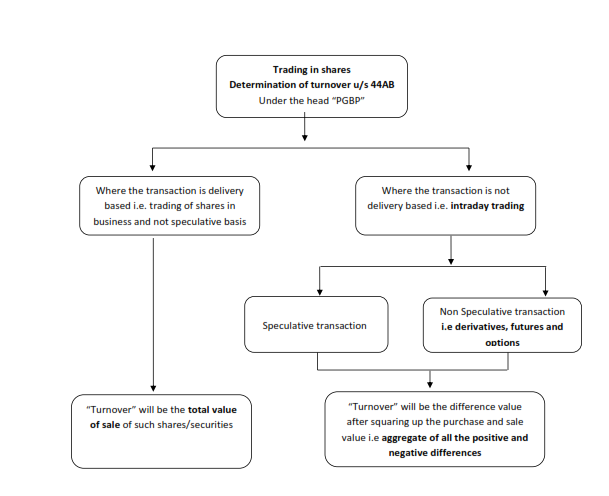

DETERMINATION OF TURNOVER:

DETERMINATION OF TURNOVER IN RESPECT OF SPECULATIVE TRANSACTION

Now, your attention may be directed to the Para 5 of “Guidance Note on Tax Audit under Section 44AB of the Income Tax Act,1961" issued by The Institute of Chartered Accountants of India (ICAI), which provides the guidelines regarding "Turnover or Gross Receipts in respect of transactions in shares.." as follows:

a) In a speculative transaction, the contract for sale or purchase which is entered into is not completed by giving or receiving delivery so as to result in the sale as per value of contract note.

b) The contract is settled otherwise and squared up by paying out the difference which may be positive or negative. As such, in such transaction the difference amount is 'turnover'.

c) In the case of an assessee undertaking speculative transactions there can be both positive and negative differences arising by settlement of various such contracts during the year. Each transaction resulting into whether a positive or negative difference is an independent transaction.

d) Further, amount paid on account of negative difference paid is not related to the amount received on account of positive difference. In such transactions though the contract notes are issued for full value of the purchased or sold asset the entries in the books of account are made only for the differences.

e) Accordingly, the aggregate of both positive and negative differences is to be considered as the turnover of such transactions for determining the liability to audit vides section 44AB, whether the differences are positive or negative.

DETERMINATION OF TURNOVER IN RESPECT OF NON SPECULATIVE TRANSACTION

Determination of turnover in case of F&O is one of the important factors for every individual for the income tax purpose. Turnover must be firstly calculated, in the manner explained below:

1. The total of positive and negative or favorable and unfavorable differences shall be taken as turnover.

2. Premium received on sale of options is to be included in turnover.

3. In respect of any reverse trades entered, the difference thereon shall also form part of the turnover.

Here, it makes no difference, whether the difference is positive or negative. All the differences, whether positive or negative are aggregated and the turnover is calculated.

DETERMINATION OF TURNOVER IN RESPECT OF DELIVERY BASED TRANSACTION:

Where the transaction for the purchase or sale of any commodity including stocks and shares is delivery based whether intended or by default, the total value of the sales is to be considered as turnover.

5. When is audit required?

An audit is required if you have a business income and if your business turnover is more than Rs 2 crores (was Rs 1 crore until FY 16/17) for the given financial year. Audit is also required as per section 44AD in cases where turnover is less than Rs.2 Crores but profits are lesser than 8% of the turnover and total income is above minimum exemption limit.

Therefore, the applicability of tax audit will be as follows in case of F&O Trading:

5.1 In case of Profit from transactions of F&O trading

a) In the case of profit from derivative transactions, tax audit will be applicable if the turnover from such trading exceeds Rs. 1 crore.

b) Tax audit u/s 44AB r/w section 44AD will also be applicable, if the net profit from such transactions is less than 8% of the turnover from such transactions.

5.2 In case of Loss from F&O Trading

In case of Loss from derivative trading, since profit (Loss in this case) is less than 8% of the turnover, therefore Tax Audit will be applicable u/s 44AB read with section 44AD.

6. Tax Treatment:

Business income: If you are trading in the stock market frequently (mostly non-delivery trade), returns from it can be classified as follows:

6.1. Speculative Business income: Profit from intraday trading is categorized under speculative business income. Tax treatment is similar to your Business income tax. It is taxed as per the tax slab you fall in while losses can be offset only against speculative gains.

6.2. Non-speculative Business income: Income from trading futures & options on recognized exchanges (equity, commodity, & currency) is categorized under non-speculative business income. Tax on share trading in such cases is similar to your business income tax. The profits on F/O trading are taxed as per the tax slab you fall in whereas losses on such F/O trading can be set off against business profit.

7. Treatment of Adjustment for loss

7.1 Loss in respect of non speculative business income:

As per the Section 71 of the Income Tax Act, loss in respect of such business can be set off against any other heads of income including income from speculative business but excluding income under the head “salaries” of that year.

As per Section 72 of the Income Tax Act, if there is any such loss which is not set off against the above said incomes, such losses are eligible to be carried forward and set off against the other incomes excluding income from salary for a period of 8 subsequent assessment years in the manner as specified in the above order of set off.

7.2 Loss in respect of speculative business income:

As per the Section 73 of the Income Tax Act, loss in respect of speculative business cannot be set off against any other heads of income i.e. it can be set off only against other speculative incomes if any in that year.

If there is any such loss which is not set off, such losses are eligible to be carried forward and set off only against speculative incomes for a period of only 4 subsequent assessment years.